If you’ve decided to go global with your business, you’ll already know that good localization is the key to success in any international market.

This involves much more than just making sure your translations are up to scratch. The most successful brands conduct an in-depth analysis of their target market and consider cultural specifics before taking the plunge outside of their native market.

We talk a lot about localizing well. Personalization and localization are vital components of a positive user experience, with research showing that 92.2% of consumers prefer to shop and make purchases in their local currency. Another point that came up in our recent blogs about breaking into the French and German markets was the importance of offering the right payment methods when it comes to international eCommerce. Local payment habits can vary significantly from region to region, so consider this factor when tailoring your eCommerce platform to your target market.

While credit cards remain one of the world’s most favoured payment methods, young shoppers, in particular, are moving away from plastic. As the pandemic pushed more of us into online purchasing in 2020, Buy Now, Pay Later schemes also saw a steep incline in usage. Increasingly popular with millennials and Gen-Zers, some BNPL providers saw growth of 200%+ from 2019-2020. So, should you be adding a BNPL option to your website? We’re walking you through what you need to consider before deciding.

What is Buy Now, Pay Later?

You’re probably familiar with the term by now, but we’ll clarify nonetheless. As the name suggests, BNPL schemes allow customers to purchase a product immediately but spread the cost over time, without paying interest. While the concept seems simple, bear in mind that different providers offer different options – we’ll explore this in a little more detail below.

Who are the providers of BNPL?

We’ve rounded up 5 of the biggest to give you the run-down.

#1 Klarna

With 90 million consumers across 17 countries, this Stockholm-founded giant allows shoppers to either delay their full payment for up to 30 days or split it into 3 equal installments.

#2 Afterpay

The Australian company – known as Clearpay in the UK – offers a 4 part installment plan across a 6-week duration.

#3 Affirm

Describing its method as ‘pay at your own pace’, this US fintech offers several payment plans at the checkout point, allowing customers to choose the plan that best suits them.

#4 Sezzle

Offering the same plan as Afterpay, this US platform is behind its main competitors. However, Sezzle is still making waves across North America, Asia, Europe and Oceania.

#4 PayPal

We’ve all heard of this one, but did you know they offered BNPL? The US juggernaut joined the race last year when they added an installment option to their services.

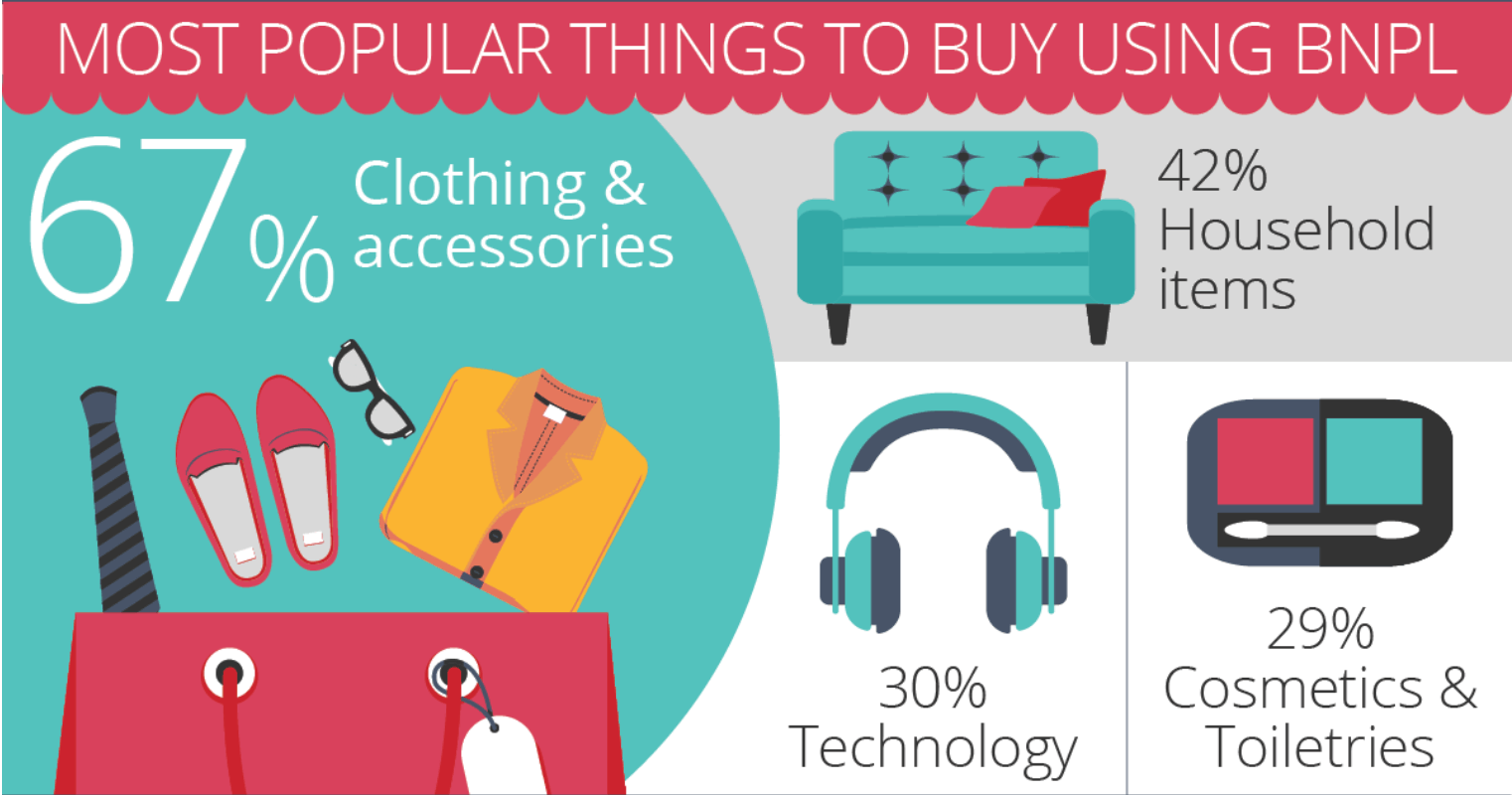

Pure Profile’s 2019 survey infographics on BNPL.

Where is BNPL popular?

While the BNPL craze has swept across much of the globe, these platforms have naturally experienced higher demand in certain regions above others. Let’s take a look at a few regions in which business is booming for the BNPL fintechs.

#1. Southeast Asia

Fuelled by a rising number of internet users across the Asia-Pacific region, BNPL usage is on the rise in South East Asian countries. Leading Singaporean-American gaming conglomerate Razer has launched several digital payment initiatives in recent years and, in late 2020, partnered with Rely to start offering a BNPL service. Another Singaporean-based fintech, Hoolah, which launched in 2018, now partners with over 1500 stores across Singapore, Malaysia and Hong Kong, offering instalment-based payments. Other names to be aware of include Grab<,Attome and Pine Labs.

#2. Australia

With a hive of activity in South-East Asia, it’s no surprise that APAC was predicted to be the fastest-growing in terms of BNPL adoption between 2020 and 2027. Casting our gaze over to Australia, such platforms are also becoming increasingly popular with consumers. One reason for the Aussies’ interest in BNPL could be that their younger buyers are moving away from credit cards. Of course, Afterpay is one of the biggest players here; another is ZipPay, which offers the same payment model. Research showed that nearly 2 million Australians used a BNPL scheme in 2019, with that number expected to double by 2023.

#3. USA

BNPL is doing extremely well in North America. According to The Ascent’s 2021 study, 56% of consumers currently say they have used a service; the dominant player being Paypal, followed by Affirm and Klarna. The study also showed that, despite being the least likely to ‘Buy Now, Pay Later’, usage among the 54+ category grew by 98% between March 2020 and March 2021. Seems it’s not just Gen-Z with an appetite for the service!

Unsurprisingly, the US companies are ahead of the game, with Quadpay offering an in-store service and Affirm now offering a BNPL card for bigger purchases. And, with the US eCommerce market worth $340 billion – its dominance rivalled only by China – it’s clear that jumping on the BNPL bandwagon here could be highly beneficial.

#4. UK

In 2020, Coherent Market Insights identified Europe as holding the second most dominant position in the BNPL market, behind the USA. In the UK alone, spending is expected to increase from £9.6 billion in 2020 to £26.4 billion by 2024. BNPL is the fastest-growing online payment method here, which is not set to change in the next 4 years. Again, younger people are the biggest fans, with millennials being the most likely to use the service.

Klarna is dominating the UK BNPL market, with Clearpay and Laybuy also throwing their hats into the ring.

#5. Scandinavia

Given that multi-billion startup Klarna was founded in Sweden, it’s hardly a surprise that it found its way into the top 3 preferred payment methods of Swedes, Norwegians, Danes and Finns alike as far back as 2017. And for Klarna’s position in Northern Europe, the future looks bright.

Frontira’s deep dive into the rapidly growing BNPL market in Europe.

Aside from this, it’s also worth mentioning that Klarna also ranks highly in the payment habits of Germans and Austrians. As the largest eCommerce market in the EU, the German market is definitely one to have on your radar when considering expansion options for your business.

What are the pros and cons of BNPL?

Pro: Expanded User Base

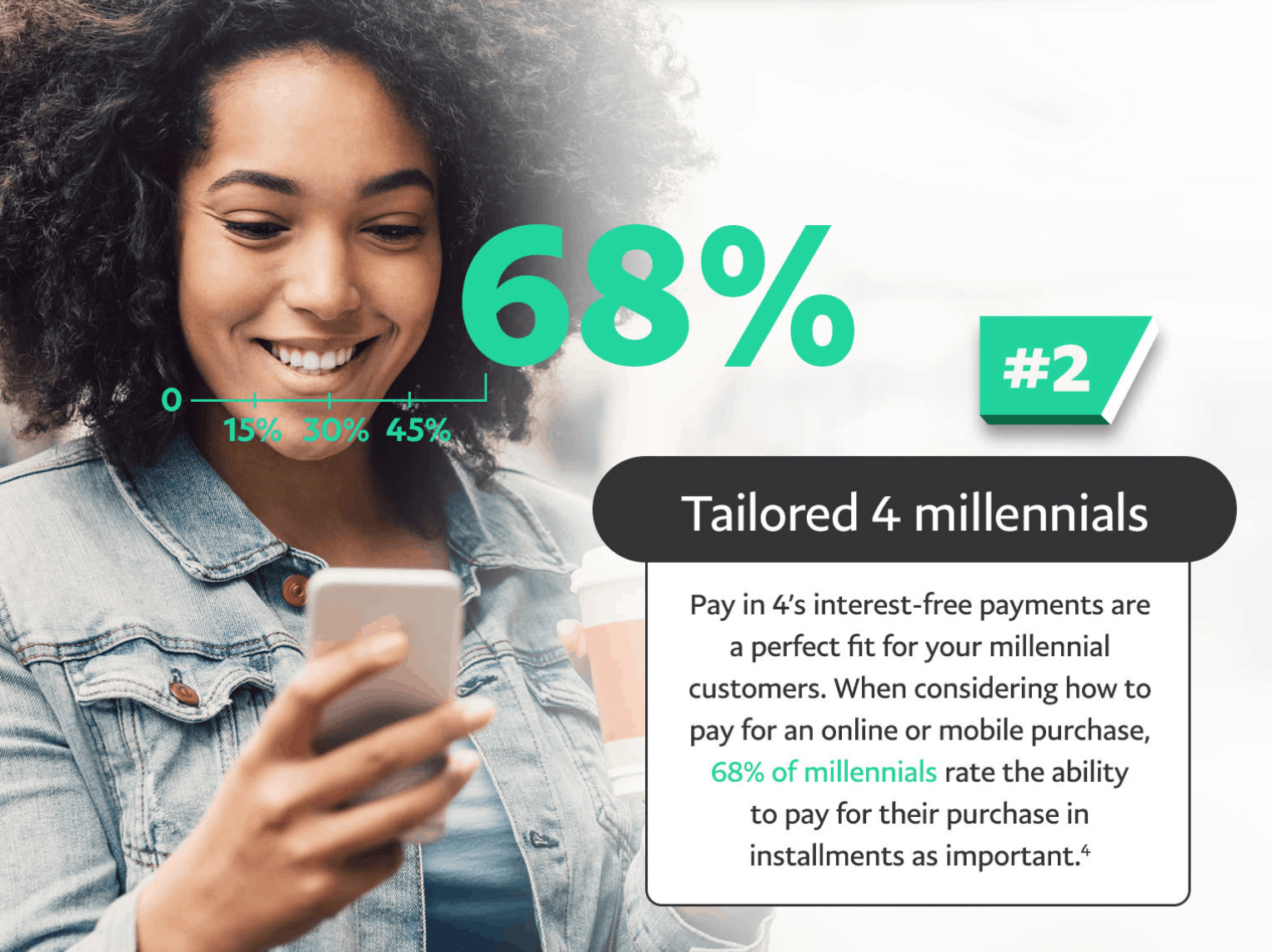

We’ve already discussed the fact that younger generations like to use BNPL; it’s convenient, modern and smartphone-friendly. They are also less likely, in general, to own a credit card. Adding a BNPL to your checkout is a great way to appeal to millennial and Gen-Z audiences.

As well as this, the option to spread payments is highly appealing to lower-income buyers, making big-ticket items more affordable to all.

Pro: Increased Sales

Because of this affordability factor, merchants adopting BNPL have seen a rise in their average order value. PayPal, for one, boasts a 56% increase in overall AOV for businesses using their pay-over-time service. US platform Bread also cites examples of increasing total sales revenue, conversion rate and average cart size.

Kaleido’s 2020 report predicts a total spend of $680 through BNPL by 2025, meaning the market’s value will reach over 12% of total eCommerce spend on physical goods. Now is as good a time as any to add a BNPL option to your online checkout!

Con: Merchant Fees

Integrating BNPL comes at a cost. Generally, a company like Klarna or Afterpay will take a percentage of every purchase made through them. While you won’t know exactly how much this will be until you submit information and request a quote, a quick Google search can give you an idea about each platform by what other merchants are saying. So, despite attractive statistics on sales and conversion, it might not be worth it for smaller ticket items.

Con: Customer Debt

While BNPL services are appealing because of the no-interest aspect, some do charge late fees. Klarna, for instance, reserves the right to use debt collection agencies and states that late payments can negatively affect credit. Some argue that BNPL services are leading more young people into debt; in the UK, the services are now going to be regulated in an attempt to avoid this.

Paypal’s infographics on how BNPL helps fashion retailers.

How does BNPL work for retailers?

The concern surrounding customer debt is only an ethical one for retailers, who receive the full amount immediately. Just be sure to check each provider’s policy on merchant disputes before going ahead.

If you do decide to integrate BNPL, make sure you’re choosing the right platform for your target market. With a company like Affirm, it’s easy to go global, since customers will be able to view and purchase in their home currency, without any conversion fees. However, be sure to check out the options in each country, rather than presuming the big American and European players to be the only way to go. China’s retailers, for instance, are mostly developing their own installment systems, and the list of Southeast Asian providers is also extensive.

Lastly, remember that one size doesn’t fit all when it comes to localizing your payment methods.

A fast-growing global phenomenon, the hype surrounding Buy Now, Pay Later is certainly not unsubstantiated. However, the important thing is to choose the payment method that aligns with your brand and works best for your target audience.

(For more tips on eCommerce localization, check out our blogs on what to focus on beforehand and how eCommerce translation works!)