The current pandemic has forced us all into what has been described consistently as a ‘new normal’.

While we await vaccinations with bated breath, the disparity between how different industries have been affected is gargantuan. The hospitality industry has been hamstrung, with small independents and huge chains alike crippled by a decimation in footfall. On the other hand, eCommerce has flourished under the global lockdowns, becoming somewhat of an essential service.

The new normal; online

The pandemic caused a sudden global shift towards online, pushing all facets of life to a new ‘from home’ edition. Work-from-home, learn-from-home, play-from-home have all become the new norm with a large increase in remote work, e-learning, and virtual socials.

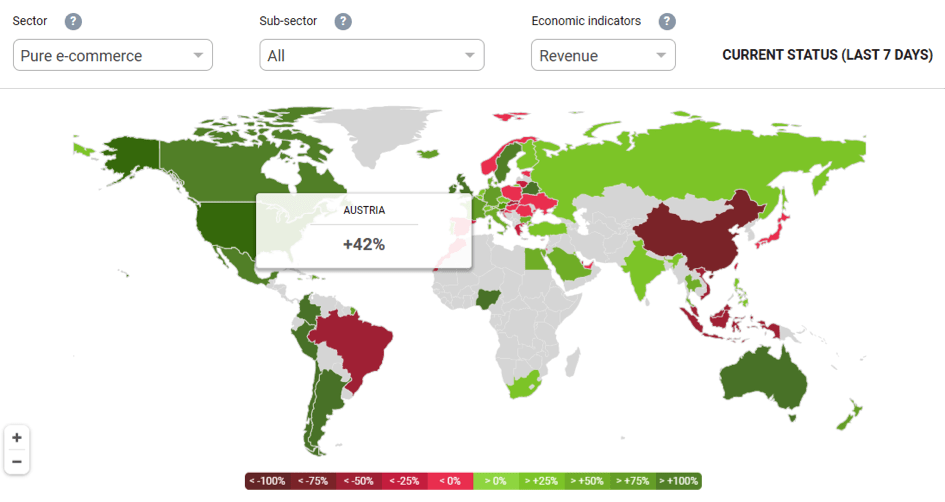

Nevertheless, given the contrast in how different countries have responded to the pandemic, surely the ‘consumer response’ differs wildly too. We’ve put together some updated insights and metrics from around the web to showcase how eCommerce trends are shifting.

How much has global eCommerce grown?

eCommerce has made vast gains throughout the pandemic, a trend that is only set to continue. One only has to look as far as Amazon which quickly became the ‘default retailer’ for the pandemic.

“Amazon is expected to exceed $100 billion in quarterly revenue for the first time ever in the fourth quarter.”

– FactSet

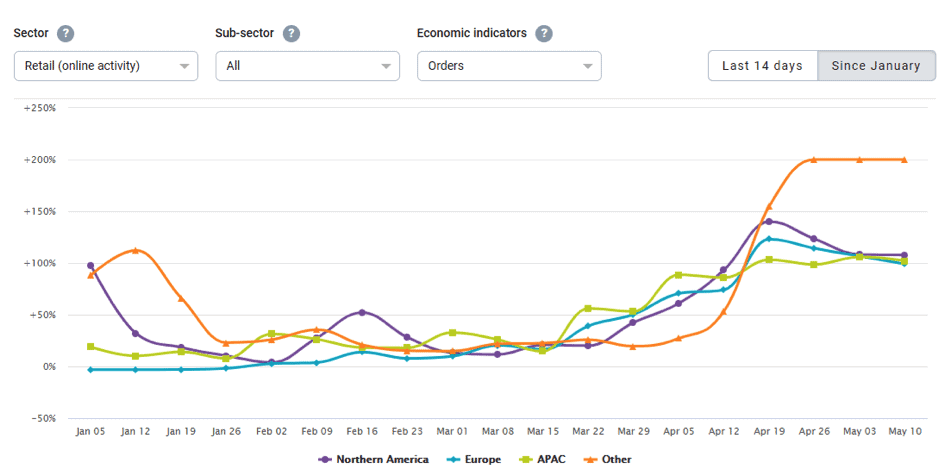

E-commerce has shown not only month by month growth but like-for-like growth compared to the same time last year too.

This of course is dependent on several factors, most notably different countries’ responses to the pandemic. The lockdown in the US was shorter compared to elsewhere in the west. Nevertheless, even taking this into account, US e-commerce has shown 5 years worth of growth in 6 months.

“Since the outbreak, the share of customers in Europe making more than half of their overall online transactions has risen between 25 and 80 percent.”

– Kantar

The Q1 and Q2 regional trends show that eCommerce has even hit numbers similar to Christmas/New Year holiday levels.

What is being bought online?

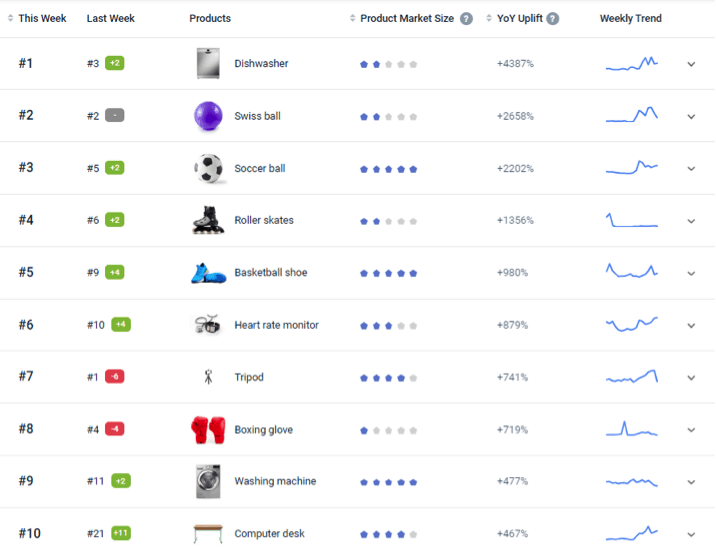

As the pandemic has continued, eCommerce trends have shifted to meet new needs. Early on, groceries and work-from-home items ranked highly, as did home fitness and DIY purchases.

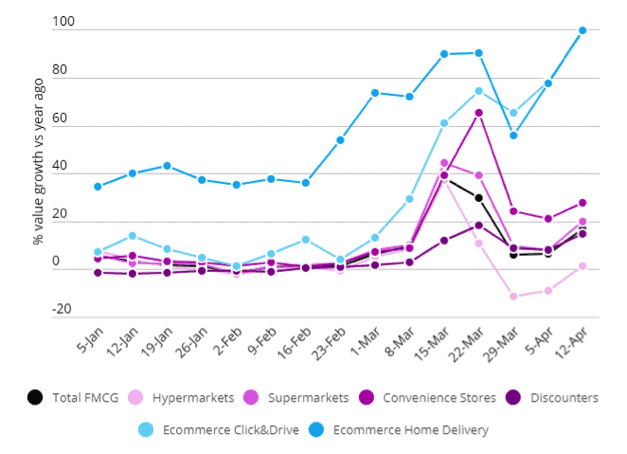

The e-grocery sector showed massive growth, with shoppers keen to avoid supermarkets. E-grocery sales in the UK for September were up 76% from last year, with 1 in 5 households ordering online.

Likewise in France, in Q1 and Q2 we can see that consumers now prefer ordering groceries online. Keep in mind that the data below shows an increase compared to last year, so this is even more indicative. The question remains will these behaviours stay the same as the pandemic plays out?

Is the ‘new normal’ here to stay

Drawing concrete conclusions at a time of such global upheaval are exceptionally difficult. However, it certainly seems like the pandemic has accelerated e-commerce trends rather than just creating them.

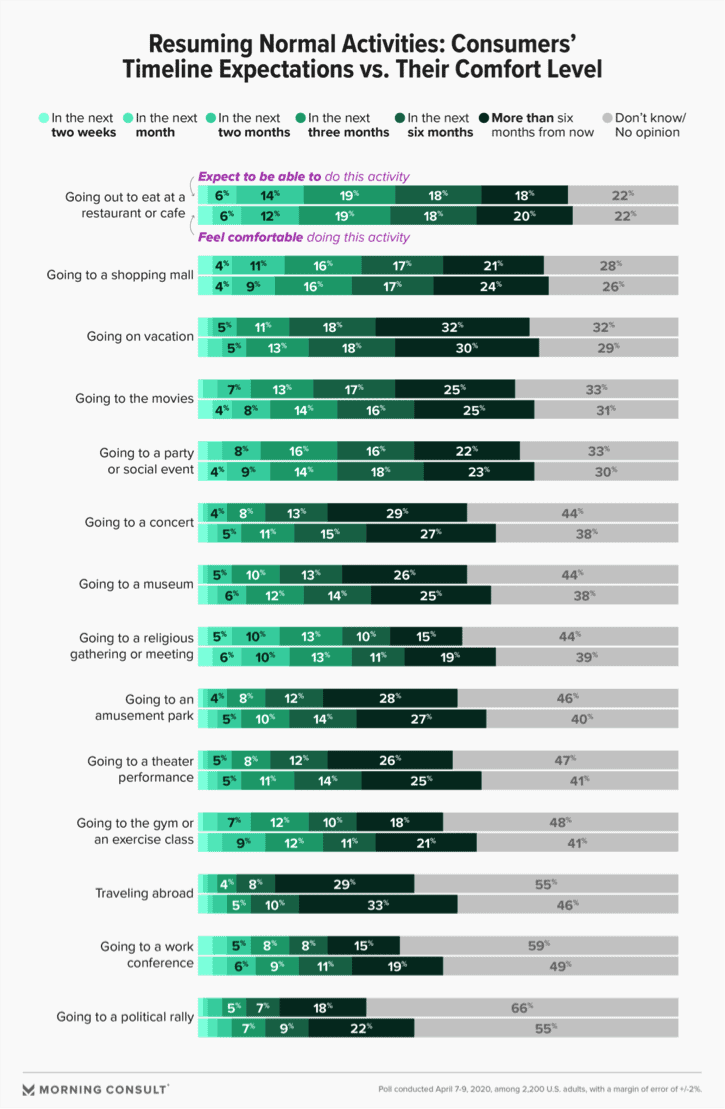

Morning Consult publishes week-to-week data on consumer comfort levels in a sample of 2200 US adults. Although the sample size is small and geo-specific, it gives an indication of consumer comfort levels regarding specific activities.

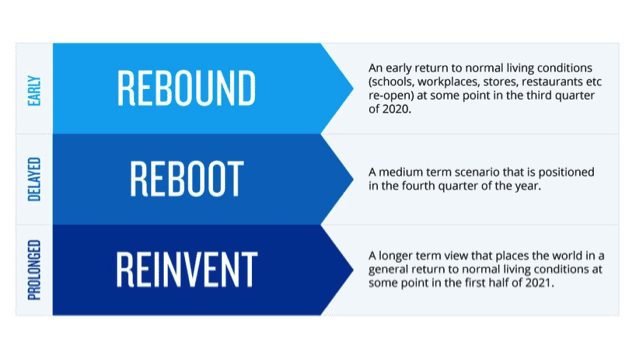

More markets are moving to a Reinvent exit as the scale and duration of the pandemic has become apparent.

E-commerce, like everyone else, is going to have to adapt to new consumer behaviour. As the graphic below shows, as time goes on we see a shift from Respond to Reprioritize and finally Reset.

COVID meets Black Friday

Every year Black Friday starts earlier and ends later, with many brands now opting for a ‘Black Friday Week.’ Don’t forget Cyber Monday is now in the mix too, and doesn’t appear to be going anywhere.

So the question is, with eCommerce already in overdrive due to the pandemic, what kind of perfect storm will the two things happening together create?

Given that many Black Friday sales usually take place in brick and mortar stores, this year, it was bound to be different.

“Barclaycard, which processes nearly £1 in every £3 spent in the UK warned that overall payments made to retailers between midnight and 4 pm on Friday had plunged by 16.7% compared with the same time a year ago.”

– The Guardian

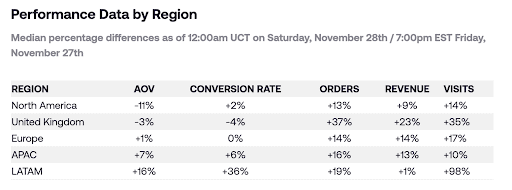

IMRG predicted UK online retail sales could grow by 35-45% year-on-year this Black Friday. Given the tentative figures below their prediction seemed pretty accurate. As you can see, regionally there was still considerable uptake in e-commerce as consumers sought to bag themselves a bargain.

Black Friday is more often associated with Veblen goods, things that people don’t need but want – predominantly apparel and electronics. But with the preexisting e-commerce boom caused by the pandemic prioritizing other items, there may be a shift. DIY, fitness and household appliances are expected to feature much more than they usually would.

Where does it leave global eCommerce?

It’s now common that the pandemic is accelerating preexisting and expected eCommerce trends. It is hidden how rigidly changed consumer behaviour is post-Covid.

You might ask what all of this has to do with TextUnited and website translation?

“Cross-border e-commerce sales expected to rise an average of 63% YoY across the festive season.”

– EShopWorld

As more countries face further lockdown measures, retailers cannot overstate the importance of targeting international markets. As cross-border selling becomes more important, your ability to engage with those audiences authentically does also.

Accurately translating and localizing your website is key to this. Making sure your search engine optimization and user experience are properly localized is of paramount importance.

If you are thinking of translating your e-commerce shop to get in on the action, let us know!