Last week, we took a look at the EU powerhouse of Germany and 4 considerations before entering the market there.

This week, we’ve decided to apply the same considerations to the new EU second in command to Germany (post-Brexit); the French Market.

French, the language of love and diplomacy strutted into 8th in our guide to the Top 10 Languages for Localization. The official language of 29 countries, two-thirds of native French speakers actually reside outside of France in African Francophone nations. A French translation has the added potential of future localization for emerging economies like Rwanda, Cote D’Ivoire, and DR Congo. Not to mention existing markets in Belgium, Switzerland, and Canada.

But we digress! Back to the French market and 4 things to consider before taking the dive in your quest for globalization.

#1. Consider The Consumers

France has some pretty unique trends in terms of its e-commerce consumers that push against the general segmentation elsewhere. For instance, you’d expect millennials, born and raised in the era of the internet to be the primary customer base. However, in France, your typical e-commerce shopper is 35-49 years old with the millennial 25-34-year-olds coming next.

According to Statista, e-commerce user penetration for 2021 was projected at 74.1% with 78.0% expected by 2025. These figures are most likely already underestimates in the face of how the unpredictable pandemic has boosted e-commerce exponentially.

As an international seller, you’d be remiss not to translate and localize your content for the French market. French-speaking consumers expect to shop in their native language and the effort will be appreciated as it is essentially polite. Politeness, respect, clarity, and promptness are all traits that French consumers seek in their e-commerce exploration so heed them all.

“French shoppers demand a native experience. Although many French are multilingual, 60% won’t shop

at an online store that doesn’t maintain a local presence, meaning native pricing and payment methods.”

– Shadykulova Nataliya, eCommerce in France

Translating and localizing into French will give you access to a market which almost 40% of will shop cross-border

#2. Consider The French Market

Like the German, the French market is certainly a mature one. In 2020 French e-commerce was valued at $114.4 billion and expected to reach $203.57 billion by 2026.

Within French e-commerce, online marketplaces are big business. Amazon, Vente-Privee, Cdiscount, and Auchan are frequently used by 25% of all French online shoppers. But there is an interesting niche in the French online market. It’s mainly dominated by large retailers like those above and small boutiques whose brick-and-mortar locations are still key important.

The mid-sized sellers common in the UK and Germany aren’t as prevalent, offering lots of potential growth for cross-border e-commerce.

Improved logistics and increased delivery choices have played a big role in the growth of e-commerce in France. Like their German neighbors, the French are extremely particular in how they receive products; an expectation that’s necessary to meet. Convenience, reliability, and speed all play an integral role as well as multiple choices in delivery options.

Given the countries phenomenal transport links, there is no excuse for poor delivery and it will certainly lose you, customers. Back in 2018, a Royal Mail report showed that in France, delivery is actually what matters most. 92% of French shoppers want upfront delivery information and 72% see delivery costs as the largest barrier to purchasing.

Variation of payment methods is again another key indicator for discerning French shoppers. Although credit and debit cards make up over half of the online payments, Paypal still makes up a quarter. Cartes Bancaires (payment cards) are utilized by 50% of shoppers for e-commerce purchase so are an absolute must include.

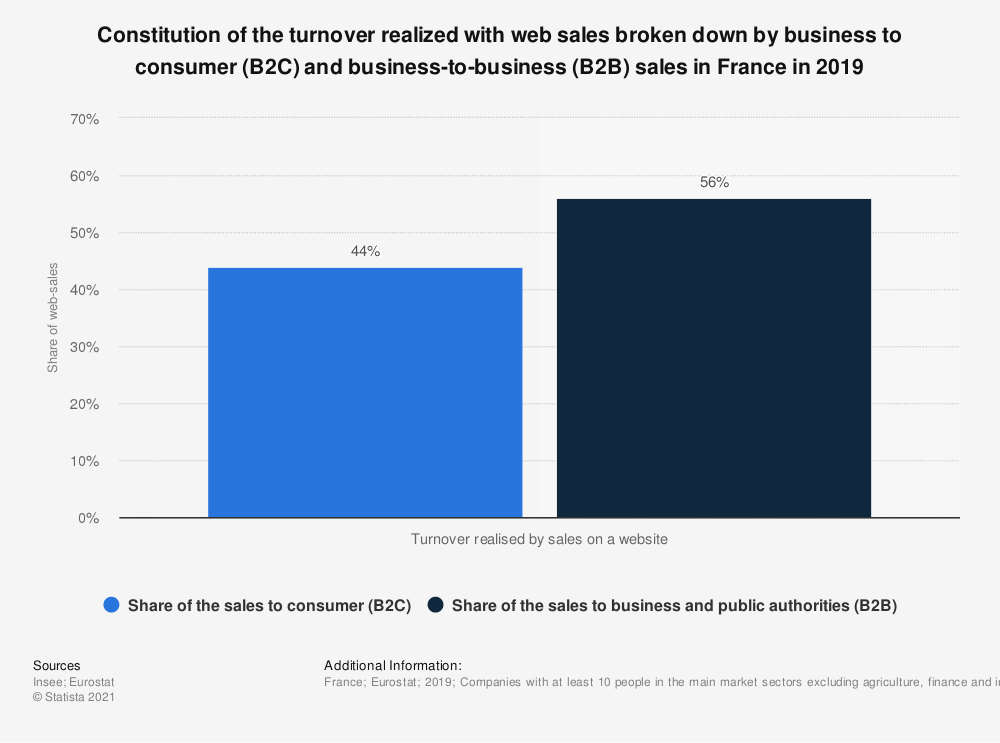

Finally, the B2B e-commerce market in France is even stronger than the B2C e-commerce market, accounting for 57% of sales.

#3. What do the French Buy?

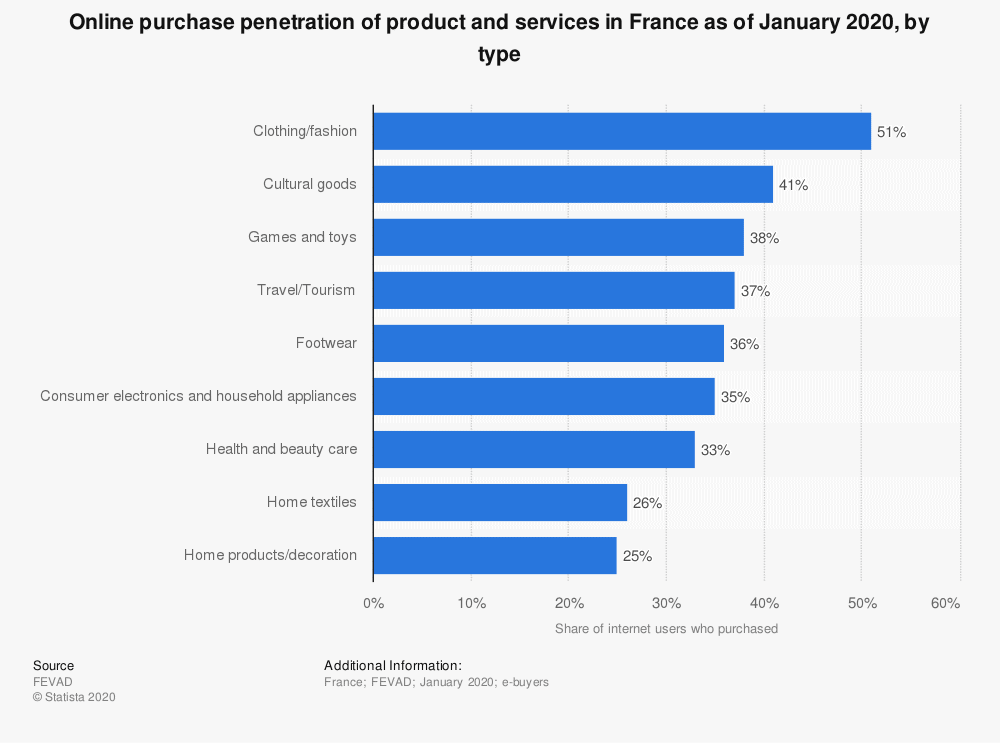

The ever-fashion-conscious French stay true to form with clothes, shoes, and accessories making up over 50% of online purchases. But remember, there is often a disparity between the domestic and foreign purchases consumers are willing to make online. Research as widely as possible how well your product is likely to be received by the target market.

#4. Look Out Below.

In our previous article on the German market, we mentioned the importance of translating well and localizing better. We’d still recommend you read that segment in relation to France but didn’t want to just paste it here again! So instead, we’ve collected some bitesize insights for your French foray in this bonus section:

- The French are notorious bargain hunters: 80% compare pricing across merchants before an online purchase – E-commerce Payment Trends: France, J.P. Morgan, 2019

Research your competition and price yourself accordingly, and try to feature your site on product comparison sites. - Online shoppers in France spend on average $70 (US) per session. – 2Checkout, eCommerce in FRANCE

Consider in-cart add-ons that may pair well with specific items available in your product catalog! - France has one of the highest fraud rates (3%) in Europe, which has resulted in heightened security concerns among French consumers. – E-commerce Payment Trends: France, J.P. Morgan, 2019

Secure and trusted payment options are a necessity for French consumer confidence. - France has a strong history and culture of consumer and privacy protections that

express themselves in the country’s eCommerce laws and regulations. Alongside GDPR, online businesses in France are subject to ‘the 1978 Act.’ – La loi Informatique et Libertés, Commission Nationale de l’Informatique et des Libertés, 2019

Make sure your data policies are in line with both the new GDPR standards but those specific to France too. - In a very short time, mobile shopping in France has evolved from a niche activity to amass trend, with nearly 40% of all online purchases now being conducted via smartphone or device. – Mobile e-commerce in France, Statista, 2020

Ensure that your site is optimized for mobile use or you face missing out on a big portion of the e-commerce market.

Let’s Summarize

As you can see, the online French market is almost completely dominated by eCommerce and is expected to grow by another 10 billion EUR this year!

This means that when you enter the French market with your content properly localized, you can gain access to millions of online buyers, which will result in increased profits.

Localizing your eCommerce into French may seem like a challenge, but you can make this step with the help of experienced people. Feel free to contact us, and we will gladly make these steps together with you!